ESG in Bulgaria – Five Factors to Watch in 2024

One of the significant questions concerning ESG issues is the cost of transitioning to a more sustainable business environment. Will it result in increased financing costs and restricted access to new borrowing, or will it, on the contrary, lead to the development of new market segments and gradual change? While we cannot provide definitive answers to these questions, in this article, we will examine five ESG drivers and regulatory changes that will be pivotal in 2024. From the introduction of the New Green Asset Ratio to the Corporate Sustainability Due Diligence Directive (CSDDD/CS3D), we will explore the conditions associated with these new requirements and the potential penalties for non-compliance.

Environmental, Social, and Governance (ESG) risks are increasingly influencing investment decisions, expansion strategies, business partner selections and market choices. Following the introduction of the taxonomy1, banks have begun aligning their lending policies with the new regulatory requirements. Consequently, their financing through European funds, guarantee instruments or bonds has become dependent on these criteria. Private investors are progressively considering the impact of their investments beyond just financial gain. This shift is motivated by ethical considerations, risk management strategies, and the recognition of the higher long-term value of sustainable products and services.

2024 is anticipated to be a pivotal year in terms of regulatory developments. An increase in mandatory ESG requirements is expected to intensify pressure on businesses to integrate ESG considerations more effectively into their operations, financial statements, and relationships with banks, suppliers, and contracting authorities. Below, we highlight five ESG drivers and regulatory changes that will be defining in 2024.

1. New Green Asset Ratio

Since 2022, it has been mandatory for European banks to report against targets aligned with the Taxonomy Regulation. The focus of reporting is now2 evolving to include key transparency indicators such as the “Green Asset Ratio” (GAR).

To whom does it apply? This change applies to banks licensed in the EU.

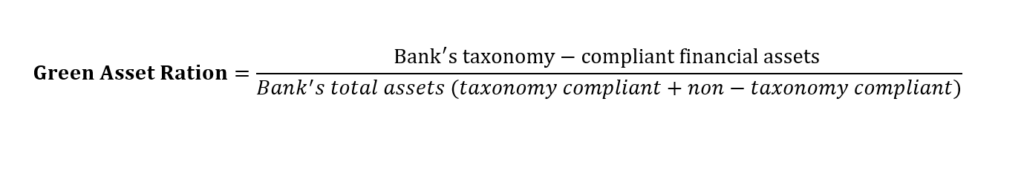

What is required? The Green Asset Ratio calculates the proportion of a bank’s financial assets, such as loans, investments in debt instruments (including green bonds), equity securities, acquired collateral, and other assets in taxonomy-compliant economic activities, relative to the total value of the bank’s assets. The calculation of the total value includes loans to sectors not yet covered by the taxonomy, loans to SMEs not yet required to report on sustainability3, interbank loans on demand and exposures outside the European Union. Generally, the formula can be illustrated as follows, resulting in a lower ratio for banks with a high share of assets not covered by the EU taxonomy:

What will the penalties for non-compliance be? Violating the reporting obligation, which is explicitly regulated in legislation (such as the Bulgarian legislation), may lead to the imposition of administrative measures4 by the Financial Supervision Commission against banks licensed as investment firms. Additionally, the indicator has a reputational impact. Despite numerous regulatory initiatives to date, initial forecasts suggest that the EU-wide Green Asset Ratio could be significantly below 10%5. In the future, it is possible that minimum thresholds for this ratio could be introduced to encourage financial institutions to increase their level of green funding. Furthermore, this ratio could be linked to capital requirements for banks and reach a level of importance comparable to their credit ratings.

When will it apply? The new requirements will apply from 1 January 2024.

2. Which Projects Will Be More Attractive for Funding?

The Green Asset Ratio, which has not been disclosed by most banks to date, may influence the projects they finance and lead to changes in lending terms. As a result of regulatory changes and in response to criticism from the European Banking Authority about the increased risk of greenwashing6 (sustainability claims that lack substance), more complex “Sustainability Linked Loans”7 have started to enter the market, following “green loans8” and “social loans9“.

What are Sustainability Linked Loans? These are loans that incentivise borrowers to achieve predefined sustainability goals. The use of funds in Sustainability Linked Loans is not limited to specific green or social projects, nor are the funds required to be spent on such projects. Any type of business activity that the borrower undertakes can be financed, including project finance, acquisition finance or revolving working capital credit. In practice, model clauses and principles developed by the private sector for this product are used10. These are not mandatory but can be included in the loan documentation to facilitate the designation of the loan as ‘sustainability-related’ in line with regulatory standards:

- Sustainability Indicators (Targets) or Key Performance Indicators (KPIs): These are determined jointly by the bank and the borrower, prior to the granting of the loan, based on the specific business. Therefore, they cannot be generally set under European or local regulation. They depend on the knowledge of the project and the data available for the sector. The targets should be ambitious yet at the same time measurable, realistic, and achievable.

- Financial Incentives for Achieving the Targets: The borrower may be incentivised with a lower interest rate premium (i.e., lower financial costs overall) or penalised with a higher one accordingly11.

- Experts: The initial selection of KPIs and the subsequent verification of compliance over the life of the loan require special expertise. The bank may have this expertise in-house, or external consultants may be brought in, which may include ESG rating agencies12.

Negotiating sustainability metrics is anticipated to be the most challenging aspect of Sustainability Linked Loans. For instance, for a technology company, appropriate sustainability indicators might include the greenhouse gas emissions of its servers and the diversity and equity of its employees and board members (in terms of age, gender, education, and work experience), provided these can be measured correctly according to scientifically sound standards. In contrast, for a manufacturing company, the targets might differ, relating to supply chain management, employee benefits, waste management, and carbon reduction. Borrowers are encouraged to present their sustainability-related strategy to the bank, along with any sustainability ratings they possess, to aid in the selection and refinement of their targets. In the real estate sector, the experience gained by developers, real estate investors, commercial building owners and banks has primarily focused on the environmental component—specifically, improving the energy performance of buildings and reducing the carbon emissions of existing ones. Other considerations, such as improving water efficiency and recycling building materials, as introduced in the Taxonomy, are still being developed. Moreover, the potential for so-called “brown buildings13” that require retrofitting to become sustainable in the future, is still underestimated. The other components of ESG, namely the social and governance aspects, are also less developed in this sector. Often, borrowers in the real estate sector are special purpose vehicles (SPVs) established with no trading history or assets other than the property being financed. These SPVs may not have a sustainability strategy themselves. However, a sustainability strategy at the group level is necessary and can be applied to the company acting as the borrower.

3. ESG Ratings

ESG ratings, primarily utilised by bond issuers in capital markets in recent years, have faced scepticism from investors due to concerns over their reliability, comparability, transparency, and independence. The European Commission has pledged to address these concerns14, and on 5 February 2024, the Council and the European Parliament reached a preliminary agreement on a proposal for a new regulation governing the activities of ESG rating agencies.

To whom does it apply? This regulation targets ESG rating providers operating within the EU, regardless of whether they are based inside or outside the EU.

What is required? The main measures concern ESG rating providers and include, among others: (i) a move to a licensing regime and supervision by the European Securities Authority for those established in the EU; for the rest, the possibility to operate in the EU subject to certain conditions, (ii) separation of rating activities from the core business, allowing the same legal entity to combine these activities as long as they are clearly separated and measures are in place to avoid potential conflicts of interest. This exception will not apply to rating providers that combine advisory, audit, and credit rating activities.

Users of these ratings, including financial market participants and financial advisers, will be required, when disclosing ESG ratings as part of their marketing communications, to include information on the methodologies used to determine the ratings on their websites. This includes the option to offer separate ratings on environmental (‘E’), social (‘S’), and governance (‘G’) factors, as well as a single rating in which the weight of the individual factors must be explicitly stated.

When will it apply? The preliminary political agreement is awaiting approval by the Council and the Parliament before proceeding to the final adoption procedure. Once adopted, the Regulation will become directly applicable 18 months after its entry into force.

4. The Corporate Sustainability Reporting Directive15 (Directive (EU) 2022/2464 or CSRD)

At the core of the new European regulations, qualitative data stands out as the primary driver. As evident in every proposed regulatory change to date, the emphasis lies heavily on the collection, monitoring, and evaluation of new data to facilitate evidence-based decision-making by investors. Moreover, high-quality and verified ESG data serves as the foundation for the sustainable products and services packages already offered by European banks, as highlighted previously.

The phased implementation of ESG public disclosure obligations, under the Corporate Sustainability Reporting Directive, was launched in early 2024. This initiative aims to modernise and tighten the rules on social and environmental information that companies must report, building upon the foundation laid by the previous Non-Financial Reporting Directive16. In Bulgaria, the process of transposing the Directive into national legislation is already underway. On March 5, 2024, the Ministry of Finance published a package of legislative amendments for public consultation, which will largely implement the Directive’s requirements17. These amendments are proposed through a Bill to amend and supplement the Accounting Act. The Ministry anticipates that the entire package of legislative changes will be enacted by July 6, 2024.

To whom does it apply? Initially, the Corporate Sustainability Reporting Directive (CSRD) applies to all large companies covered by the previous Non-Financial Reporting Directive. Subsequently, it will also extend to public SMEs and third-country companies. The draft law amending and supplementing the Accounting Act proposes revised and increased values for the indicators used to categorise “micro,” “small,” “medium,” and “large” enterprises. These categories are determined based on meeting two out of three indicators: book value of assets, net sales revenue, and average number of employees. The changes in the values align with the amendments introduced by the European Commission’s Delegated Directive (EU) 2023/2775 on October 17, 202318, to the Accounting Directive19.

What is required? Under the CSRD, companies will be required to provide sustainability reporting under the newly introduced European Sustainability Reporting Standards (ESRS)20. These standards mandate more detailed and granular data on the sustainability impact of their business. Key aspects of reporting include:

- The adoption of a double materiality approach, which entails reporting on both (a) the financial performance of an activity (such as cash flow, risk, access to finance), and (b) its impact on sustainability issues. This includes disclosure of information regarding how the business activity affects the planet and people, such as carbon emissions, workforce diversity, and respect for human rights.

- A broader scope of the data to be disclosed, which encompasses the company’s entire business chain.

This approach ensures the integration of ESG factors into the overall business cycle and promotes the transition towards a circular economy model that minimises waste. Implementing this reporting will require significant strategic planning, particularly concerning people and resource utilisation. According to the rationale provided by the Ministry of Finance regarding the proposed amendments to the Accounting Act, it is anticipated that approximately 3,700 enterprises will experience a reduction in administrative burden. These enterprises are expected to transition from the small category to micro-enterprises due to the changes in the size of financial indicators used for categorisation. Additionally, around 350 medium-sized enterprises are projected to transition to small enterprises. All these companies could potentially benefit from a simplified form of the new financial reporting.

What will be the penalties for non-compliance? The Directive mandates EU member states to establish investigation and compliance structures to impose “effective, proportionate, and dissuasive” sanctions for non-compliance. Penalties will be determined by individual Member States in transposing the CSRD into local legislation, considering factors such as the severity and duration of the breach and the financial condition of the company.

When will it apply? The CSRD is being phased in as of 2024. Initially, public companies with more than 500 employees, including those whose shares are traded on EU regulated markets, banks, insurance companies, and other entities designated by national authorities as public interest entities, will be obligated to comply.

5. The Corporate Sustainability Due Diligence Directive (CSDDD/CS3D)

Following the political negotiation by the EU in December 2023 of the Corporate Sustainability Due Diligence Directive (CSDDD/CS3D), its final draft was published on 30 January 2024. The next steps involve voting on the text in the European Parliament and adopting it by mid-2024.

To whom does it apply? The directive will apply to a wide range of companies, including those based outside the European Union (as outlined in Article 2 of the directive) broadly as follows:

| From the EU | Outside of the EU |

| (a) ‘Very large companies’ with more than 500 employees and a net worldwide turnover of more than EUR 150 million for the last financial year for which they publish annual accounts. | (a) ‘very large companies’ that have generated a net turnover of more than EUR 150 million in the EU. |

| (b) Companies in ‘high impact’ sectors (this includes sectors such as textiles, agriculture, food and beverages, mining, fossil energy, construction and building materials, and chemicals) that have more than 250 employees and a net worldwide turnover of more than €40 million, of which more than €20 million is generated in ‘high impact sectors’. | (b) companies in ‘high impact’ sectors that generate, within the EU, a net turnover covering the thresholds specified for those from the EU. |

Bulgaria will have the right to decide whether to expand the scope of the Directive to include pension companies regulated by Regulation (EC) No 883/2004 and Regulation (EC) No 987/2009. For now, banks, alternative investment funds, undertakings for collective investment in transferable securities, insurance and reinsurance companies are exempt from this regulation, although this exemption is subject to review. Micro-enterprises and SMEs are also not among those entities that are currently obligated, but they could potentially be indirectly affected by the measures. To ensure clarity, the European Commission is expected to publish a list of non-EU companies that will be subject to these requirements.Several Member States already have legislation in place to regulate the sustainability screening of companies, such as the French law on vigilance of parent and contracting companies21 and the German law on supply chain22. For many multinational companies, determining which regulation to apply proves to be a highly intricate issue. For instance, consider a German limited liability company ‘X’ with 2,000 employees, a turnover of €140 million, and a balance sheet of €45 million. Despite meeting the headcount requirement, this company falls short of the financial requirements of the Sustainability Check Directive. However, it will be subject to the German Supply Chain Due Diligence Act starting from 2024, as a result of different criteria under this law. Additionally, the company will also be obligated to comply with the Sustainability Reporting Directive as it meets two out of three criteria specified therein. On the other hand, let’s consider the English company ‘Y’, which has 2,000 employees and a turnover of EUR 200 million in the EU, but lacks physical or legal presence within the EU. Despite this, the company will still be subject to the new reporting legislation, specifically the Sustainability Reporting Directive, as it meets the turnover requirement.

What is Required? Companies will basically need to:

- Integrate effective due diligence policies into their corporate policies and procedures, including:

- Identifying, assessing, preventing, mitigating, and stopping actual and potential human rights and environmental harm.

- Implementing due diligence measures not only within their own operations but also within those of their subsidiaries and business partners throughout their supply chain, focusing on their “chain of custody” (i.e., specific links in the supply chain).

- Adopting and implementing remedial measures to cease and minimise adverse impacts. These remedial measures may take various forms, such as providing targeted support for ESG measures to suppliers.

Companies will also need to establish and maintain a notification mechanism and a complaints procedure, monitor the effectiveness of their due diligence policies and measures and publicly disclose information regarding their due diligence. Furthermore, companies will also need to adopt a transitional climate change mitigation plan, ensuring that their business strategy is compatible with the Paris Agreement target of limiting global warming to 1.5°C.

The Directive will increase pressure for greater transparency regarding the chains of activities of the affected parties, necessitating adaptations in their commercial relations and policies. To address negative impacts, companies need to engage directly not only with their direct suppliers but also their indirect suppliers. There will be an increasing reliance on ESG to provide quality and reliable data, leading to the inclusion of specific provisions in contracts between counterparties.

Private litigation is also likely, in addition to the currently prevalent proceedings initiated by state regulators or NGOs. Such commercial disputes may relate to the failure of suppliers or customers to meet their obligations to ensure sustainable business or even disputes relating to the management and protection of commercially sensitive information.

What will the penalties for non-compliance be? The local legislation transposing the Directive will introduce administrative penalties, which can be up to 5% of the net worldwide turnover of the previous financial year. Additionally, civil liability for damages caused by non-compliance will also be provided for.

When will it apply? The largest companies affected by the Sustainability Check Directive will be given a three-year grace period from its enactment and incorporation into local legislation to meet the new requirements. It is anticipated that 2027 will serve as the deadline year for compliance for these major enterprises. Meanwhile, smaller entities will likely have a more extended timeframe, ranging from four to five years, to adapt to the new sustainability check requirements.

Download this article here

- (Regulation (EU) 2020/852). The EU Taxonomy provides a common classification system for sustainable activities and thus serves as a tool for green financing. Its aim is to help financial market participants identify environmentally sustainable economicactivities and channel funds towards them. ↩︎

- Delegated Regulation (EU) 2021/2178 ↩︎

- Directive 2014/95/EU on the disclosure of non-financial and diversity information (“Non-Financial Reporting Directive”). https://eur-lex.europa.eu/legal-content/en/TXT/?uri=CELEX:32023R2772. Political agreement reached on 8 February 2024 between the European Parliament and the Council regarding the Commission’s proposal to postpone the directive by two years. This is part of the Commission’s efforts to reduce the administrative burden on companies and to decrease reporting requirements by 25%. https://ec.europa.eu/commission/presscorner/detail/en/mex_24_707 ↩︎

- The disclosure obligation for banks is introduced by Regulation (EU) 2021/2178, which is directly applicable. It aims to regulate

the detailed application of the provisions of Article 19a or 29a of Directive 2013/34/EU, which have not yet been transposed into

Bulgarian law. This is expected to be achieved through amendments and/or supplements to Articles 48 – 50 of the Accounting

Act. ↩︎ - https://www.eba.europa.eu/sites/default/documents/files/document_library/Publications/Reports/2021/1001589/Mapping%20Cli

mate%20Risk%20-%20Main%20findings%20from%20the%20EU-wide%20pilot%20exercise%20on%20climate%20risk.pdf ↩︎ - In 2023, the European Union mandated that the European Insurance and Occupational Pensions Authority (EIOPA), along with the European Banking Authority (EBA) and the European Securities and Markets Authority (ESMA), define greenwashing and address specific instances and complaints related to it. The first EIOPA report was published in June 2023, with the final report expected in May 2024 (“Advice to the European Commission on Greenwashing” – europa.eu). ↩︎

- In 2023, the European Union mandated that the European Insurance and Occupational Pensions Authority (EIOPA), along with the European Banking Authority (EBA) and the European Securities and Markets Authority (ESMA), define greenwashing and address specific instances and complaints related to it. The first EIOPA report was published in June 2023, with the final report expected in May 2024 (“Advice to the European Commission on Greenwashing” – europa.eu). ↩︎

- “Green” loans are loans in which the proceeds (or a significant portion of them) are allocated to projects or activities that yield a positive impact on the environment. These may include initiatives such as renewable energy, energy efficiency, pollution prevention, sustainable transport, or other environmental projects. The borrower is required to provide periodic reports on the environmental impact of the financed activities. ↩︎

- “Social” loans are loans where the funds (or a significant portion of them) are utilized for projects or activities aimed at achieving positive social outcomes and addressing social issues such as poverty reduction, access to healthcare, affordable housing, education, or community development. The borrower is expected to report on the progress and effectiveness of its social initiatives. ↩︎

- One such example is the principles, guidelines and model contract clauses developed by the London-based Loan Market Association. ↩︎

- In the example clauses mentioned, a breach of the benchmarks does not result in early repayment of the loan. ↩︎

- Sustainability Coordinator and External Reviewer. ↩︎

- The IFC estimates, based on the Global Trade Analyses Project, that only about 7% of the world’s building stock is currently green. Page 21 of “Building Green”, “Sustainable Construction in Emerging Markets”, IFC. October 2023. “Brown” buildings refer to conventional structures lacking energy or emissions reduction measures.https://www.ifc.org/content/dam/ifc/doc/2023/building-

green-sustainable-construction-in-emerging-markets.pdf ↩︎ - In 2023, the EU took action to regulate ESG rating providers by proposing a regulation on transparency and integrity of ESG rating activities in July, as part of its renewed sustainable finance strategy (COM(2023) 314 final). ↩︎

- Directive (EU) 2022/2464 or CSRD. ↩︎

- Directive 2014/95/EU on the disclosure of non-financial and diversity information (“Non-Financial Reporting Directive”). ↩︎

- https://www.strategy.bg/publicconsultations/View.aspx?lang=bg-BG&Id=8192 ↩︎

- Directive 2013/34/EU on the annual financial statements, consolidated financial statements and related reports of certain types

of undertakings. ↩︎ - https://eur-lex.europa.eu/eli/dir_del/2023/2775/oj ↩︎

- The first set of these standards was published in the Official Journal of the EU on 22 December 2023 in the form of a delegated regulation, which is available at: https://www.consilium.europa.eu/bg/press/press-releases/2024/02/05/environmental-social-and-

governance-esg-ratings-council-and-parliament-reach-agreement/ ↩︎ - LOI n° 2017-399 du 27 mars 2017 relative au devoir de vigilance des sociétés mères et des entreprises donneuses d’ordre ↩︎

- Lieferkettensorgfalts¬pflichtengesetz, short: “LkSG”. ↩︎