First organised GoO market in Hungary: kick-off in early summer 2022

Trading guarantees of origin (GoO) are becoming more popular in Hungary. Due to the increasing market demands, the Hungarian Power Exchange (HUPX) will launch an organised GoO market from 9 June 2022. Leading up to this, the HUPX recently published the Auction Code of the GoO market (i.e., the HUPX GO platform) effective from 26 April 2022.

1. Legislative Background

Implementing the EU Clean Energy Package into Hungarian legislation by the amendment of Act No. LXXXVI of 2007 on Electric Energy and Government Decree No. 309/2013 (VIII. 16.) provided the green light for an organised GoO market in Hungary (see our previous article Changes to the rules on guarantees of origin in Hungary).

From 2013 onwards, the Hungarian Energy and Public Utility Regulatory Authority (HEPURA) has also been developing the regulatory framework for trading GoOs. The HEPURA became a member of the Association of Issuing Bodies (AIB) in May 2021 and the European Energy Certificate System (EECS) from 1 February 2022. From this point forward, GoOs could be transferred without much of the earlier administrative difficulties (i.e., GoOs became transferable without registration, cancellation or accreditation by the HEPURA).

In line with the foregoing, the HUPX decided to launch a GoO auction system in two phases: (i) a Feed-in-Tariff (FiT) GoO auction from 9 June 2022 and (ii) a full-scale GoO auction from the end of 2022. On the new HUPX GO platform, GoO trading and other related transactions may be conducted through standardised contracts.

The HUPX GO platform is designed to be an auction-based market with automatic opening and closing dates stated in the trading calendar. The HUPX maintains a registry of tradable products that are listed either in the AIB or the HUPX register. In exceptional cases, the HUPX may suspend trading on the platform.

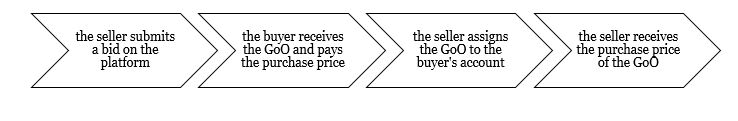

The HUPX also keeps a bid book where bids can be submitted, modified or cancelled during the opening hours. At each close of the auction, the HUPX publishes the results of the given trading period and the bids are settled afterwards. The trading mechanism is as follows:

2. Notable Provisions of the Auction Code

Traders have the possibility to decide whether they want to enter into a contract with the HUPX in order to use the HUPX GO platform. If they choose to do so, the contract is concluded for an indefinite period and its content is determined broadly discretionary by the HUPX. Unless otherwise agreed, the contract may not be transferred or assigned.

HUPX GO membership requires, inter alia:

- a GoO account held at the HEPURA (i.e., an electronic account containing details of the GoOs);

- compliance with the conditions for traders set out in the Auction Code;

- a valid HUPX GO membership agreement;

- a designated trader (a natural person who completes the transactions for the HUPX member trader company);

- appropriate technical and IT equipment.

The application for membership requires the submission of various documents (e.g., corporate information, account contract concluded with the HEPURA). The HUPX decides on the application for admission within 15 days, allowing an additional 15 days for submitting the missing documents (if any). After accepting the membership request, the HUPX notifies the trader of their first available trading date. Members shall also apply for the registration conducted by the HEPURA within 15 days. GoOs can only be purchased on the traders’ own accounts, consequently, agency services cannot be carried out on the HUPX GO platform.

Traders are required to pay a quarterly fee of EUR 250 for using the HUPX GO platform. However, traders who register before the first GoO auction on the HUPX GO platform may be exempted from paying the fee this year. The expected transaction fee is 0.03 EUR/MWh and the export fee is 0.014 EUR/MWh which will be applicable for AIB registries to the HEPURA.

The HUPX may impose sanctions on traders in certain cases, such as:

- the notification on minor offences and infringements;

- a fine for material breaches of trading rules or failure to comply with the prior notification;

- the suspension of a trading license;

- termination of membership.

During the application of such sanctions, the HUPX takes into account the seriousness, frequency and consequences of the infringement. The detailed features of suspension and termination are summarised below.

| Suspension of trading license | Termination of membership | |

| Cases of application | if HUPX suspends the trader’s membership as a sanctionin an emergency situation based on technical conditionsin the absence of a designated natural person traderin the event of blocking the trader’s account contract with the HEPURAin the event of certain insolvency situations | if the HUPX terminates the trader’s membership as a sanctionif the trader gives a 30 days’ notice of termination;if the suspension period ends, or if the reason for suspension is not remedied or the suspension is not extended on requestin the event of a termination of the trader’s account contract with the HEPURA |

| Other | If the trader ceases the activity which results in suspension, the HUPX may immediately withdraw the suspension, and the trader can resume its activity on the platform. The registry of designated natural person traders cannot be suspended; therefore they are removed from the register either upon request or upon termination of the trader’s HUPX GO membership. | In case of termination, an official notice shall be published by the HUPX. On termination of membership, the fees paid shall not be recoverable. The trader shall be obliged to fulfil the obligations arising from transactions carried out on its behalf and from contracts concluded before termination. |

Traders may be authorised to provide liquidity services upon the approval of the HUPX, where traders keep a certain volume of GoOs on the market. Traders may receive a fee discount and other benefits for such liquidity services under the terms of a separate (non-public) agreement concluded with the HUPX. Only HUPX members are entitled to carry out liquidity services.

The HUPX ensures that traders can submit and cancel their bids instantly on the HUPX GO platform. The use of the cancellation function is subject to a specific code prepared by the trader.

The HUPX GO market is strictly limited for GoOs that comply with the applicable legislation and AIB rules. The HUPX ensures transparent, fair and non-discriminatory operation of the HUPX GO platform.

3 FiT GoO Auctions

According to the HEPURA, renewable production is continuously growing in Hungary, therefore the amount of domestic GoO will increase significantly. The majority of renewable energy production is generated by power plants operating under the FiT support scheme, which is automatically purchased by the TSO (MAVIR Zrt.). Thus, the related GoOs certifying the renewable origin of the FiT production are also registered for the TSO, which has grown into a market of sufficient volume.

Accordingly, in the first phase of opening the GoO auctions, the HUPX will focus on the FiT GoOs. At the FiT GoO auctions, the TSO, being the exclusive owner of the FiT GoOs, is the only seller. Consequently, HUPX GO members may only participate as buyers on the HUPX GO platform (single seller model). Afterwards, the purchased GoOs can be traded, i.e., traders may sell GoOs for their buyers.

The HUPX intends to launch an auction platform for non-primary FiT GoOs and secondary GoOs, where the number of sellers will be unlimited. The auction frequency is planned to be monthly. This auction platform is expected to be launched by the end of 2022 or in early 2023.

4 Summary

In terms of the continuously developing GoO legislation, market participants may face a major challenge (e.g., publication of lower level auction rules, commencement of the multiple seller platform, and expected regulatory corrections). In addition, further changes are also expected. It is therefore essential to keep track of the legislative developments, and Wolf Theiss will continue to provide the latest information and can offer expert counsel on these topics.