Generating electricity from renewable sources in CEE & SEE

2024 Edition of the RES guide

Wolf Theiss is proud to announce the release of the tenth edition of The Wolf Theiss Guide to Generating Electricity from Renewable Sources in Central, Eastern, and Southeastern Europe for 2024. This latest version replaces the previous guide published in 2022 and brings updated insights into the rapidly evolving renewable energy sector in our region.

Overview of developments and legislative changes

In response to the EU Member States’ ambitious 2030 targets, the past four years have seen robust investment into renewable energy projects, encompassing both generation and storage capabilities. The ongoing conflict in Ukraine underscores the critical need for energy security across Europe, accelerating the shift from dependency on imported fossil fuels to a more sustainable reliance on renewable energy sources.

This edition of the Guide documents substantial advancements and technological improvements in the generation and storage of electricity from renewable sources (RES-Electricity). It aims to support increased investment in the CEE/SEE region by providing a detailed overview of the pertinent laws and regulations.

New additions and structural updates

Significant updates include revisions to the RES-Electricity legislation across 13 countries since our 2022 edition. A notable addition is a comprehensive section on Power Purchase Agreements (PPAs), which are expected to enhance the bankability of RES-Electricity projects throughout the region. This guide also covers the recent introduction of Contracts for Difference (CfD) schemes in selected countries, which together with PPAs will facilitate the shift away from previous subsidy models, such as Green Certificates and Feed-in Tariffs, which have historically led to market distortions.

For ease of use, all country chapters maintain a consistent structure to simplify cross-referencing, with defined terms applicable only within the specific country discussed.

With each edition of our guide, we aim to empower stakeholders by demystifying the legal landscape of renewable energy in the region. This comprehensive resource supports informed decision-making, fostering a sustainable and secure energy future.

Bryan W. Jardine

Partner, Wolf Theiss

Brief description of Power Purchase Agreement structures

Power Purchase Agreements are one of the most discussed topics in the current electricity market. They can provide the certainty of revenue income that a RES developer needs, in order to secure lending to build a RES project.

This brief description is intended to highlight the types of power purchase agreements (hereinafter “PPA“) currently available in the CEE/SEE region. In our country chapters, we will outline the current status of the PPA market and the expectations going forward.

The first criteria used for the differentiation of PPAs is the method for the delivery of electricity, specifically if the PPA involves physical delivery of electricity or not (thus being a pure financial hedge in the form of a virtual PPA).

1. Physical delivery of electricity PPAs can be further differentiated in two sub-types:

- On-site physical delivery PPA;

- Sleeved PPA

On-site physical delivery PPA

An on-site physical delivery PPA is an agreement concluded between a power generator and a power purchaser in which electricity is generated and consumed at the same site. This type of PPA is often used for small-scale renewable energy projects, such as rooftop solar panels installed on supermarkets or factories. Such PPA could also be used for generation facilities that are connected to nearby off-takers by means of private/direct wire, without using public electricity grids.

Sleeved PPA

The Sleeved PPA is an off-site PPA that involves the delivery of electricity to the end customer through public grids and through the use of an energy supplier that acts as an intermediary.

The Sleeved PPA is mostly used in jurisdictions where the generator cannot directly enter into a direct agreement with the end customer due to restrictions on the sale of electricity to end customers, which are not directly connected to the electricity generator by private wire. In this scenario, a service provider, like an electricity supplier, is employed to facilitate the “sleeving” process of electricity. This involves managing the transfer of electricity, guarantees of origin, and monetary transactions between the power generator and the end consumer. For providing this service, the supplier receives a fee, known as the “sleeving fee”.

2. Virtual PPA

A virtual PPA is a purely financial contract in which no physical flow of electricity occurs from the power generator to the off-taker. The virtual PPA is a hedging instrument modelled on the contract for difference, meaning that the physical flows of electricity are not connected to the financial flows resulting from the virtual PPA.

Considering that the virtual PPA does not involve a transfer of electricity, the off-taker still needs to meet its electricity consumption through traditional channels—therefore, the relationship of the off-taker with its supplier remains unchanged.

The basis of the virtual PPA is the “strike price” – (i.e. guaranteed price for the agreed volume of power output generated by the producer). The equation is as follows:

- If the price achieved by the generator following the sale of the electricity on the competitive market is greater than the strike price, the generator pays the positive difference between the sale price and the strike price to the off-taker.

- If the price achieved by the generator following the sale of the electricity on the competitive market is lower than the strike price, the off-taker will pay to the generator the difference between the strike price and sale price.

Power generators will often sell the electricity they produce to purely corporate buyers such as telecoms, retail chains, data centre operators or similar, thus creating a so-called corporate PPA. Alternatively, they will sell the electricity they produce to large utilities or traders, creating a so-called utility PPA.

Finally, in some jurisdictions, the producer may sell the electricity it produces to a government entity under the market-premium model (also a contract for difference similar to a PPA), thus creating a so-called governmental PPA.

You can download the entire guide below. Individual country-specific chapters are also available for download in the respective country sections

Full guide download

Austria

In late 2019, the Austrian Federal Government submitted to the EU Commission a comprehensive plan to achieve several climate protection targets by 2030 (#mission2030), as required by the new EU framework. In its plan, Austria has set itself the goal of increasing the share of energy from RES as part of gross energy consumption to 46–50% by 2030. Another ambitious goal is to cover 100% of Austria’s total electricity consumption from RES by 2030.

To this end, it is expected that a number of adaptations to the Austrian legal framework will occur in the years to come, which may include:

- the strengthening of financial support for the expansion of renewable energies by increasing subsidies (such as the new Renewable Energies Expansion Act, which entered into force in late July 2021); and

- the digitisation of the energy system, including the transport and distribution networks.

Moreover, the current geopolitical situation with Russia’s aggression against the Ukraine has led to an extraordinary situation that requires comprehensive measures to permanently replace natural gas imports from Russia. This is primarily due to the current high gas prices and the highly uncertain future of natural gas supplies. Against this background, there are significant economic incentives to reduce overall gas consumption and substitute natural gas with domestic renewable energy sources. In general, Austria intends to avoid gas supplies from Russia by 2027. However, according to the Federal Ministry for Climate Action, Environment, Energy, Mobility, Innovation and Technology, which is responsible for energy matters, this will require efforts on three levels:

- reduction of gas consumption in Austria;

- expansion of the domestic production of biogas and green hydrogen; and

- coverage of the remaining consumption of natural gas by alternative routes.

Consequently, it is estimated that in the years to come, solar and photovoltaic capacities as well as investments in wind, biomass and other RES will increase. Furthermore, Austria is an interesting market for investors and project developers because of a guaranteed Feed-in Tariff encouraging RES project development.

Download the Austrian chapter

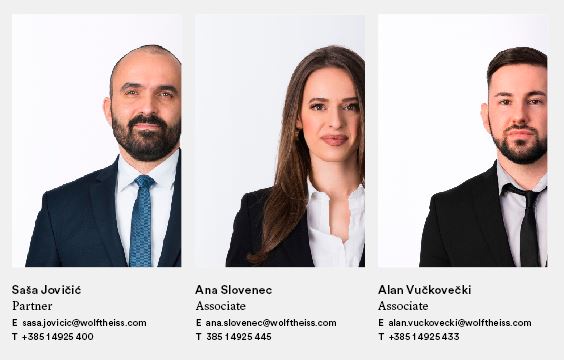

Related experts

Bosnia & Herzegovina

The BiH Framework Energy Strategy established the following five (5) strategic priorities for development of the RES sector until 2035:

- Standardisation of cooperation mechanisms with other countries in order to implement measures and programmes for stimulating RES-Electricity production.

- Prescribing the benefits of connecting to the transmission system for power plants that generate RES-Electricity, if it provides a safe system of operation and is based on transparent and non-discriminatory data.

- Increase of the share of RES-Electricity generation (that enters the incentive system) in overall electricity generation, along with adequate system organisation.

- Regulating the utilisation of the minimum levels of energy from RES for construction of new or renovating existing facilities, and enactment of regulations to govern the implementation of cogeneration in the heating and cooling sector.

- Achievement of the goal of a 10% share of RES in energy generation for transport in 2020 and continued promotion of biofuels through 2035.

Download the Bosnian and Herzegovinian chapter

Bulgaria

According to the requirements of the Clean Energy Package, with an outlook towards 2030, Bulgaria has committed to new RES energy production targets of 27.09% (the target for 2020 was sixteen percent (16%)) and energy efficiency savings of 27.89%. Further, as an EU Member State, Bulgaria is actively involved in ensuring that all available planning tools for the European Green Deal are coherently deployed. In addition, Bulgaria has elaborated and committed to CEP targets with its Integrated Plan for the Energy and Climate 2021-2030 EC, with particular national targets related to Decarbonisation, Energy Efficiency, Energy Security, Internal Market and Research, Innovation and Competitiveness. Therefore, it is expected that Bulgaria will transpose the required legal provisions in its legislative framework for the necessary investments to accelerate the transition to clean energy.

According to the Bulgarian Integrated Plan for Energy and Climate 2021-2030 EC, the RES national targets for energy from renewable sources with respect to gross end consumption of energy by 2030 are separated into 3 main areas– namely (i) share of electricity from RES of gross end consumption of electricity – 30.33%; (ii) share of heat energy and energy for cooling RES – 42.60%; and (iii) share of RES of end consumption of energy in the transport sector- 14.20%:

Download the Bulgarian chapter

Related experts

Croatia

For the period until 2030, certain activities aimed at increasing the safety and flexibility of the electricity system are expected. These special efforts are anticipated to focus on the development of reversible hydropower plants and battery storage and on the organisation of market balance. These achievements will allow electricity to be accumulated when it is cheaper and then sold at a better price when needed. The storage of energy should establish a better integration of variable and intermittent renewable energy sources into the grid. Moreover, further improvements in the software tools responsible for precise scheming of the electricity production should mitigate the risk of imbalances in the system caused by intermittency.

Additionally, better integration is planned with further investments in the design of the electricity market, in which intraday trading should ultimately be approximated to real-time trading. Balancing real-time production and consumption should bring significant stability to the variable nature of renewable energy, in which the levels of supply and demand are often not coherent.

Further advancements in the development of the RES system are anticipated upon the full implementation of the revisions to the EU directives within the Clean Energy for all Europeans Package. Currently, implementation is pending for the revised Energy Efficiency Directive (EU/2023/1791), which took effect on 10 October 2023, and the revisited Renewable Energy Directive (EU/2023/2413), commonly referred to as RED III, effective since 20 November 2023. RED III mandates an increase in the overall EU RES target from 32% to 42,5%, in order to significantly accelerate the current pace of deployment of renewable energy and phase-out the European Union’s dependence on Russia.

Download the Croatian chapter

Related experts

Czech Republic

In 2018, the EU Renewable Energy Directive was issued with a target of at least 32% energy production from RES by 2030. In 2023, the Directive was revised and the EU’s goal was raised to a minimum of 42.5% with an aspiration of up to 45% energy production from RES by the year 2030.

The Czech Republic is required to enact specific measures to meet the EU’s 42.5% target. The Czech contribution to meeting this EU-wide goal is adjusted based on its geographical, climate and economic conditions. The Czech Republic has set a target for RES-Energy to make up 30% of total energy consumption by the year 2030. The data from 2022 show that RES-Energy accounted for 18.195% of total consumption in the Czech Republic in 2022.

In order to meet the new goals under the Clean Energy for all Europeans package and The REPowerEU Plan, and to help the EU to reach its goal under the European Green Deal, substantial investments in the Czech Republic is needed.

Download the Czech chapter

Related experts

Hungary

The evolving landscape of the energy sector in Europe anticipates significant market transformations. Therefore, Hungary, recognising the strategic importance of the energy sector, has renewed its National Energy Strategy to align with recent technological and market changes, EU regulations, and state asset policies. The updated strategy aims to bolster energy sovereignty and security, sustain the benefits of reduced energy costs, and decarbonise energy production through a mix of nuclear and renewable sources, crucial for countries like Hungary with limited traditional energy resources.

The revised National Energy Strategy and the related action plans provide a vision for the future of the Hungarian climate and energy sector up to 2030, while also providing an outlook towards 2040. The main objectives are to make the energy sector “clean, smart and affordable”, focusing on consumers, (i.e., strengthening of security of supply, making the energy sector climate-friendly, and promoting innovation and economic development). The National Energy Strategy envisages a progressively transformative electricity market dominated by solar and nuclear power, with fossil electricity generation contributing only 10%.

Renewable energy is one of the main focus areas with clear targets for the electricity, thermal and transportation sectors, setting a 21.3% share of RES in the electricity sector, 28.7% RES in the heating and cooling sector and 16.9% RES in the transportation sector by 2030.

Achieving these targets will ensure a far more stable and balanced renewable energy mix. In view of the growing importance of weather-dependent, mainly photovoltaic generation capacity in RES-Electricity production, the strategy aims to increase solar capacity to nearly 6,500 MW by 2030 and to nearly 12,000 MW by 2040. In addition, similar expansion is anticipated for wind turbines, despite the currently low installed capacity (expected to increase from approximately 330 MW to 1,000 MW).

Download the Hungarian chapter

Related experts

Montenegro

In their national strategy and commitments to the Energy Community, the Montenegrin Government had committed to increasing the percentage of RES as part of total final consumption to 50%. The Montenegrin Government went on record to confirm that these goals were fulfilled. Based on the Report on Energy Realisation for 2022, Montenegro produced 1,780.94 GWh of electricity from RES, which is 55% of their total production of electricity. However, the remaining 45% was produced from coal-powered thermal power plants.

The largest hydropower potential is currently exploited through the HPP Perucica (over 700GWh per year) and HPP Piva (over 600 GWh per year). According to Wind Europe data, wind farms in Montenegro, particularly 46 MW Mozura and Masdar’s 72 MW Krnovo, sometimes produce inexcess of 40% of Montenegro’s total electricity needs.

The RES potential of Montenegro, in that regard, seems well-utilised but also shows great potential for growth, particularly in the domain of solar where potentials are largely considered untapped. Recent studies show that wind and solar power plants could cover all 217,000 households in Montenegro, with the potential of solar being estimated up to even 2.7 GW.

An interesting topic in Montenegro is also the potential for development of off-shore wind farms, but at present such initiatives still seem stalled by the lack of regulatory framework as well as infrastructure deficiencies. Poor road infrastructure remains one of the key hurdles for on-shore developments, particularly for wind power projects.

The key priorities in further development of the Montenegrin energy sector are achieving greater interconnection with the region and the EU, further liberalisation of the local market, strengthening the knowledge and capabilities of local authorities, and increasing private sector participation in infrastructure investments. State-owned EPCG is still considered the largest producer and trader in the market.

At the time of the drafting of this Guide, a new draft of a Renewable Energy Law was in the works, which should address some of these main challenges and introduce auctions for premiums into the Montenegrin market. Additionally, the adoption of the new Law on Cross-Border Energy Infrastructure Projects is pending and, once in place, is expected to assist regional integration.

Download the Montenegrin chapter

Related experts

Poland

In 2023, Poland produced almost 166 TWh of electricity, of which 44 TWh came from RES Facilities (half supplied by onshore wind farms). The share of electricity generation through coal in Poland in 2023 fell to 63%, the share of electricity generation through renewables rose to 27% and the share of generation through gas reached 10%. While the share of gas remains at this level, we have already seen that coal and renewables have shown the fastest changes ever in 2020. Extremely high levels of electricity prices in 2022 and 2023, combined with an upcoming phase out of coal fired electricity plants has turned Poland into one of the biggest RES Facilities construction sites in Europe. The statutory electricity price control measures applied in 2023 on electricity generation were lifted on January 1, 2024. The rapid growth of solar projects has caused the Polish market to experience its first ever case of negative electricity prices in 2023.

With an unusually high share of lignite and hard coal in the Polish energy mix (when compared to other EU members states) the new government of Poland, which took over on December 13, 2023, must significantly revive and update its national energy policy. It must set new targets for the full decarbonisation of the entire economy by 2040, as recently proposed by the European Commission. The parties forming the new government, campaigned on the promise of defining a new energy policy document by the end of 2024 related to, the rapid growth of nuclear and RES Electricity generation, along with a controlled phase out of coal and lignite.

Experts emphasise that the development of the hydrogen market will continue, with the problem of balancing supply and demand. The relatively few programmes or subsidies aimed directly at hydrogen consumers will be key to the increased use of this new fuel and thus meeting regulatory targets. In addition, Poland’s burgeoning ESG policy is only just beginning to function effectively, which is in line with the expectations of foreign investors who require this, in order to engage in Polish energy projects.

It is estimated that the Polish energy sector requires PLN 1.3 – 1.7 trillion of investment by 2030. This amount includes, according to experts: (i) spending on investments in the development of new energy sources, (including a massive offshore wind program); (ii) development of both large-scale nuclear electricity generation facilities and SMRs; (iii) investment in upgrades and extensions of electricity and gas transmission and distribution networks; (iv) energy storage; and (v) green hydrogen investments.

Download the Polish chapter

Related experts

Romania

According to the new European requirements, as a Member State, Romania should work to ensure that all available planning tools for the European Green Deal are coherently deployed. Therefore, it is expected that Romania will adopt a legal framework for the necessary investments to accelerate the transition to clean energy.

As per the provisions of Romania’s National Plan in the field of Energy and Climate Change submitted with the European Commission, pursuant to the requirements of the Aarhus Convention, Romania proposes a clear plan to support further investments in RES-Electricity; mostly in wind and photovoltaic energy.

The digitisation of the Romanian energy system, including transport and distribution networks (“smart grids”) also plays an important role in reducing own technological consumption (OTC) and increasing the production of RES-Electricity as well as in transforming the Romanian energy market into a “fit-for-RES” market aimed at increasing integration of RES.

In Romania, it is estimated that in the coming years, photovoltaic capacities will be developed both in the form of medium-capacity solar parks, built on degraded or non-productive lands, and in the form of small capacities dispersed by the energy consumers who can make the transition to prosumer status.

It will also be necessary to replace electricity generating facilities that will be out of operation by 2030 with new, efficient, low emission and innovative investments in new capacities for electricity generation. To this end, the capacities anticipated from the repowering activity considered in the above-mentioned National Plan are:

- Wind energy – 3 GW installed capacity;

- Photovoltaic energy – 1.35 GW installed capacity

This should be done in the context of achieving the objectives of energy security, competitiveness and decarbonisation of the energy sector.

Download the Romanian chapter

Related experts

Serbia

The Serbian National Action Plan for RES, which was adopted in 2013, envisaged a 27% share of RES within final energy consumption in Serbia by 2020. This target was not met by 2020 and has still not been achieved. Based on the most recent reports from the European Commission, Serbia has made moderate progress in harmonising its legislation, governance, and processes with the EU acquis, but Serbia’s share of RES as a percentage of its gross final energy consumption has unfortunately decreased by 1% year-on-year and was at 25.28% in 2021.

Still, Serbia has set very ambitious targets for decarbonisation and increasing RES in its generation capabilities. Serbia committed to an unconditional emissions reduction target in August 2023 of 13.2% compared to 2010 levels, or 33.3% compared to 1990 levels, to be achieved by 2030.

Notwithstanding the above percentages, the total installed capacity of RES projects is steadily increasing in Serbia. The total installed capacity of RES used for electricity generation (not including wind and big hydropower plants) increased to 190 MW in 2023. The current national energy strategy estimates that approximately EUR 200 million of investment is needed to reconstruct and modernise the district heating system and to achieve the shift from fossil fuels to RES (predominantly, biomass and natural gas). The share of electricity generation via oil in comparison to 2010 (baseline year) should decrease from 28.7% to 14.6% by 2030 and the share of generation via coal should decrease from 23% to 16.5%. By contrast, the share of generation via natural gas should increase from 48.3% to 56.4% and biomass from 3.2% to 12.5% by 2030.

One of the main obstacles to further RES development is the lack of human and technical resources in the Ministry of Mining and Energy’s Department for Green Energy. Moreover, further development of the transmission and distribution grid requires considerable investment to connect new generation plants. Balancing costs and responsibility, as well as ancillary services, are an area of particular focus at the time of publication of this Guide.

Download the Serbian chapter

Related experts

Slovak Republic

The Slovak National Climate and Energy Plan for 2021-2030 set the target of a 19.2% share from RES as part of total energy consumption, to be achieved by no later than 2030. The total investment cost for achieving the RES targets is estimated at EUR 4.3 billion. These investment costs include the electricity and heating sectors.

The Slovak Republic will strive to maximise the use of existing infrastructure in accordance with the rules adopted in the new and amended EU documents that are included in the “Clean Energy for All Europeans” package and the REPowerEU Plan. In this context, the deployment of intelligent energy and electricity storage systems is particularly important.

In view of the high share of nuclear sources in electricity production and the high share of natural gas in the heating industry, the Slovak Republic has one of the lowest energy emission levels in the EU. Some possibilities for the decarbonisation of energy include the replacement of coal with low-emission sources, as well as with alternative fuel sources, energy efficiency measures and the decarbonisation of transport.

The REPowerEU Plan aims to reduce dependence on Russian fossil fuels and combat the climate crisis. As such, the Slovak Republic took advantage of the European Commission’s opportunity to include this chapter in the recovery plan and receive additional funding for new green measures. These are divided into four key areas: (i) energy and permitting processes; (ii) building renovation and management; (iii) sustainable transport; and (iv) green skills development. These measures aim to save energy, promote a faster uptake of renewable energy and diversify the energy supply.

Download the Slovak chapter

Related experts

Slovenia

Electricity production in solar power plants represents the largest environmentally acceptable potential for increasing RES-Electricity production in Slovenia. With respect to sustainable use of space, future development should prioritise the integration of solar power plants into existing buildings, industrial sites, and degraded areas. However, a key constraint is the availability of land and the ability to integrate newly built solar power plants into the existing grid systems. As a result, the existing electricity distribution network will need to be upgraded and given the limitations of the grid system, priority will be given to the development of larger (community) solar power plants in locations where additional grid investment is not required. Increasing electricity storage capacity shall be further encouraged. To achieve the RES-Electricity goals envisioned in the draft National Energy and Climate Plan, dated February 2024 (the “NECP 2024”, Celoviti nacionalni energetski in podnebni načrt (2024)), solar powered units with an estimated capacity of up to 350 MW will have to be constructed annually.

There is currently some uncertainty regarding wind energy projects in Slovenia, particularly regarding the placement of wind turbines. The placement of wind turbines is usually postponed due to environmental protection concerns. The main concerns are the protection of endangered animal species, along with the perceived “social unacceptability” of these projects. In general, there are only a limited number of locations with suitable wind conditions where the placement of wind turbines is permitted by law. Slovenia’s wind power potential is therefore estimated at 147 MW by 2030 and between 430 and 530 MW by 2040.

To minimise negative impacts on nature, priority should be given to maximising the production of existing smaller hydropower plants, using new and more efficient technologies and revitalising inactive small hydropower plants. The location of new (smaller) hydropower plants should be limited to existing structures such as dams and bridges, and no new barriers should be built on waterways. It is therefore envisaged that the existing capacity (164 MWe) of small hydropower plants could be increased up to 171 MWe by 2030 and up to 196 MWe by 2040. This would mean an increase in current electricity production by small hydropower plants to around 425 GWh in 2030 and 490 GWh in 2040. With regard to large hydropower plants, 4,020 GWh of electricity is expected to be generated (at the generator) both in 2030 and in 2040, in the scenario with existing measures.

Download the Slovenian chapter

Related experts

Ukraine

Ukraine has demonstrated significant commitment to reforming its energy sector, in order to reach the sustainable growth targets set by numerous international obligations. The country joined the European Energy Community in February 2011 and in October 2014 set the goal of increasing its renewable energy share as part of the national power mix to 11% by 2020. In 2022, a new Ukrainian Energy Strategy was adopted through 2050 (the full text of the strategy has not yet been made public due to public safety considerations) and aims to ensure sustainable economic development through access to reliable, modern energy sources. By 2050, the strategy aims to achieve climate neutrality, promoting clean energy adoption, overcoming energy poverty, and developing decentralised systems. Aligned with the National Economic Strategy and international commitments, key goals include reducing coal dependence, modernising infrastructure, improving resource efficiency, integrating with EU markets, ensuring energy security, and fostering innovation in alternative energy solutions.

The Government has made significant efforts to stimulate and encourage the flow of foreign investment in RES projects (e.g. granted VAT exemptions on the import of certain RES equipment, simplified process of land allocation, etc.).

Despite the development of the RES market over the years, Ukraine has faced problems regarding the attractiveness of RES incentives and the support scheme. In the last two years before the full-scale Russian invasion of 2022, over 3 GW of green capacity have been put into operation at an increased feed-in green tariff (mostly solar), at the highest tariff in Europe. As a result, the energy system of Ukraine started facing difficulties with balancing green generation capacities. There have also been defaults on payments by the Government to investors in the RES sector. However, despite the ongoing war, the Ukrainian government has managed to reduce its debt to RES producers for the supplied electricity. As at February 2024, these producers have received 77.3% of the funds owed to them for the electricity they supplied in 2023.

Therefore, it seems inevitable that substantially more investment will be required in renewable energy (RES) electricity once the conflict with Russia is resolved. Moreover, legislation and regulations governing the RES market are expected to undergo significant changes in the near future, so as to adapt to the evolving landscape both domestically and internationally, as well as to spur post-war reconstruction of the RES energy sector in Ukraine. It is clear that local communities will play an ever-increasing role in this process, since they will need to formulate their own development and recovery strategies, identify priorities and develop a list of specific projects.

Starting on 1 January 2020, investors or future RES producers may enter the Ukrainian renewable market in two ways: (i) by investing into existing RES projects that are entitled to operate under the green tariff regime; (ii) by investing into RES projects operating under the new Auction Law.

Download the Ukrainian chapter