Sustainable Securitisation – too complicated or worth the effort?

Regulatory evolution

Green Bonds and Securitisation Series – Article 2/3

This is the second article in a series of articles that began with “The European Green Bond Standard – Gold standard for green bonds or regulatory burden?” and concludes with How do market players view the European Green Bond Standard?

“It’s not simple” has been the reaction of many securitisation market participants when the Securitisation Regulation introduced the concept of “Simple, Transparent and Standardised” (“STS”) securitisations back in early 2019. With the emergence of sustainable securitisations, things are again not quite as straightforward as one would wish. During its young history, the regulatory environment for sustainable securitisations has already gone through several evolutions. But despite all the complications, this development holds opportunities for the much-needed growth of the European securitisation market and the financing of the sustainable transformation of the European economy, argue Michael Osswald (Managing Director, SVI) and Christian Fahrholz (Director, TSI).

Both securitisations and sustainable finance are at the heart of the European Commission’s Action Plan on Capital Markets Union, even in its original version which dates back to 2015. Sustainable finance gained particular momentum in the aftermath of the launch of the European Green Deal by the European Commission in 2019. This is because one of the objectives of the European Green Deal is to mobilise at least €1 trillion in sustainable investments over the next decade and to channel private investment towards the transition to a climate-neutral economy.

It is therefore not surprising that sustainability considerations have already been embedded in the 2019 initial Securitisation Regulation (1) which introduced, as part of the newly established premium segment of “Simple, Transparent and Standardised” securitisations, a first set of requirements to disclose environmental information on the assets financed by certain types of STS securitisations. This was complemented, at the time of the implementation of the amended Securitisation Regulation (2) in Q2 2021, with the possibility for issuers to also publish the available information related to the principal adverse impacts of the assets financed by the underlying exposures on sustainability factors. The most prominent proposal yet to appear relates to the European Green Bonds Standard which was published in draft form by the European Commission in July 2021. This aims to establish criteria necessary for a bond to be designated “European Green Bond” across all types of unsecured and secured bonds including securitisations, and is intended to particularly support the European Commission’s Action Plan on Financing Sustainable Growth formulated in 2018. As a consequence of all of these initiatives, the regulatory environment for sustainable securitisations (3) is currently characterised by the co-existence of various elements which, in the following, we will explore in more detail.

To start with, since the inception of the STS-segment under the initial Securitisation Regulation, the transparency criteria for non-ABCP securitisations have included the requirement for originators to publish environmental performance data of underlying exposures in the mainstream asset classes of residential mortgage loans and auto loans & leases, provided that such information is available to the originator and captured in its IT systems (4). Looking at the history of the STS segment over the last 3 ½ years, the above-mentioned provision has initially resulted in very few RMBS and Auto ABS transactions publishing such environmental performance data. Originators including captive Auto finance providers have cited in many cases a lack of availability of environmental performance data and uncertainty about their correctness as the main reasons for not publishing such information. We note that over the last 12 months the number of STS transactions that report such environmental performance data is on the rise which can only be welcomed. Looking beyond the Environmental aspect, it could be argued that other STS criteria, including those in relation to simplicity and standardisation (5), already take account of sustainability ideas and objectives, in particular in relation to Governance aspects – the final letter in ESG that often gets overlooked. Examples for this are the STS criteria that require a disclosure of the originator’s underwriting standards, a minimum experience of the originator/servicer and the transaction documentation to clearly specify contractual obligations of the key transaction parties and other key structural features of the securitisation. Thus, a starting point was made in relation to sustainable securitisations.

On the flip side, however, the above-mentioned sustainability elements inherent in the initial Securitisation Regulation were not really compatible with the Sustainable Finance Disclosure Regulation (“SFDR”) (6) which came into force in March 2021 given that securitisations are not investment products in 2021 and was further detailed by the European Supervisory Authorities (EBA, ESMA and EIOPA (7)) in their draft Regulatory Technical Standards on sustainability disclosures for STS securitisations (8) in May 2022. This voluntary standard for selected asset classes, in particular residential mortgage loans and auto loans & leases (with other asset classes potentially to follow), is expected to help investors to comply with their disclosure obligations required by the SFDR from January 2023 onwards. The upcoming standard will comprise information related to “the principal adverse impacts of the assets financed by the underlying exposures on sustainability factors which is clearly more comprehensive compared to the environmental performance data required to be provided for STS securitisations under the initial Securitisation Regulation. The draft Regulatory Technical Standards provides an option for originators to choose between these two regimes, whereby only securitisations in line with the draft Regulatory Technical Standard would presumably be at least partially eligible for the SFDR requirements. The importance of this and the impact of the Green Asset Ratio should not be underestimated given that asset managers and bank treasuries represent the backbone of any investor base of a publicly placed securitisation transaction.

Lastly, the European Green Bond Standard represents a most probably voluntary standard to be used on a uniform basis across the EU for capital markets instruments that explicitly include securitisations. Published as a draft in July 2021 by the European Commission and based on the recommendations of the Technical Expert Group on Sustainable Finance, the European Green Bond Standard aims to provide standardisation, transparency and supervision of external reviewers, thereby granting assurance to both issuers and investors on the level of sustainability of their investments and reducing the risk of greenwashing.

The importance of the European Green Bond Standard for securitisations is further heightened by the recommendations spelled out by EBA in its ground-breaking March 2022 report on “Developing a Framework for Sustainable Securitisation”. The EBA concludes, among other findings, that a dedicated framework for sustainable securitisation is premature for the time being, mainly due to the current limited availability of suitable green assets to securitise. On the same token, the EBA recommends for securitisation to go the route of the European Green Bond Standard, thereby creating a single standard for all fixed income products.

However, EBA and the vast majority of market participants agree that amendments to the draft European Green Bond Standard are necessary to capture the specifics of securitisations. These amendments include in particular the need to apply the use of proceeds approach at the level of the originator rather than the special purpose vehicle (i.e. the formal issuer) to avoid that the securitised underlying exposure needs to be already 100% sustainable and to enable the originator to use the proceeds of issued notes for the financing of sustainable investments in line with the definitions of the EU Taxonomy.

The most pressing question that is currently fiercely debated between market participants, politicians and regulators is around the minimum green requirements that should apply to the underlying securitised assets that form part of a securitisation that seeks to comply with the European Green Bond Standard. A compromise proposal could be to require a random selection that will ensure that the percentage of sustainable assets of the securitised pool is not lower than the total portfolio of the originator, unless the originator chooses to securitise a higher percentage of taxonomy compliant assets. In addition, the present draft European Green Bond Standard would allow only for true sale non-ABCP securitisations to be eligible as European green bonds while synthetic on-balance sheet securitisations and ABCP securitisations, all of which are common and frequently used securitisation structures and each represent more than EUR 100 billion of issuance amount, are not enclosed in the current legislative process for the European Green Bond Standard.

As can be seen from the above, the regulatory environment for sustainable securitisation within the EU is currently very much in a state of flux. Against this background, an overview of the current market for sustainable securitisation can sharpen the understanding of how this market segment could evolve in the future.

Market overview

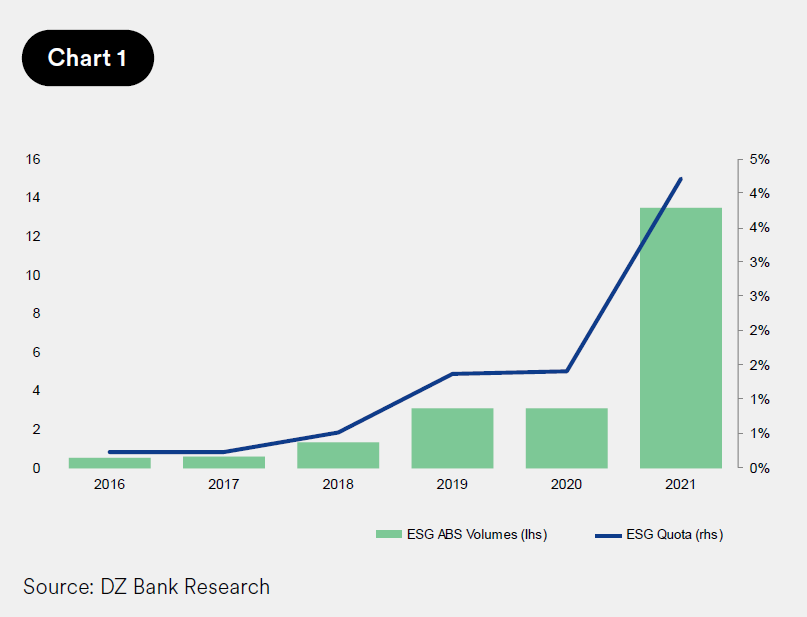

Despite the important role they could possibly play in the future for the financing of the transition to a (more) sustainable economy across Europe, the issuance amounts of sustainable securitisations in Europe are currently, despite strong recent growth, still at a very low absolute level and represent less than 5% of the total European securitisation issuance amount (see Chart 1).

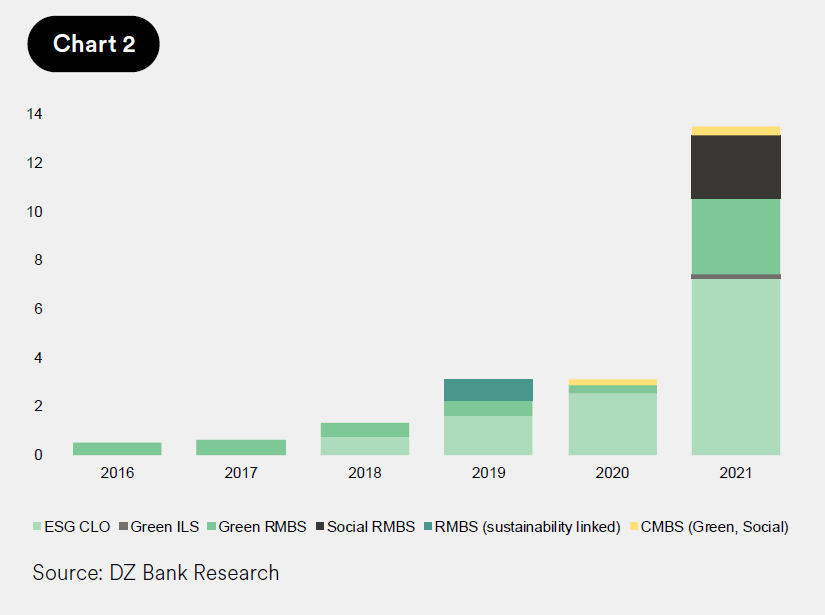

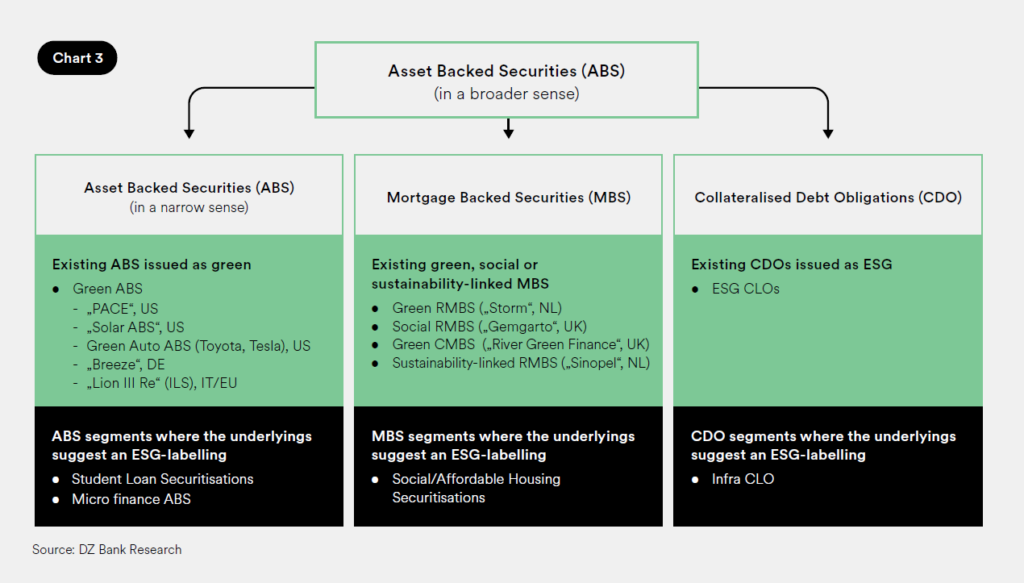

As can be seen from Chart 2, the European market for sustainable securitisations is dominated by Collateralised Loan Obligations (“CLOs”) and RMBS transactions. In terms of the number of transactions, less than 20 sustainable securitisations have been observed over the last 5 years which have included the asset classes and transaction types summarised in Chart 3 below:

Recent examples of sustainable securitisations in the European market (not mentioned in Chart 3 above) include a series of consumer ABS issued by Auxmoney as Social Bonds, a Portuguese RMBS issued by UCI and the Green ABCPs issued by LBBW and Crédit Agricole CIB through their respective ABCP programmes that refinance small ticket E-bike

lease contracts and auto lease contracts for battery electric vehicles, respectively. Virtually all of them have used the “Green Bond Principles” and the “Social Bond Principles” published by ICMA (9) which represents a concise and very workable set of voluntary frameworks issued by a private-sector association.

Outlook

One of the key features of securitisation – a financing instrument that forms part of the family of asset-based financings and similar to other types of asset-based financings such as asset-based lending for aircraft and ships and project & infrastructure financings – is that the cashflows that are used as the source of the debt service for the issued ABS notes derive directly from a well-defined portfolio of securitised loans or other underlying exposures. Due to the lack of securitisable assets such as financings for electrical and/or hybrid vehicles or loans to finance energy-efficient properties in general or to upgrade existing properties to a higher energy efficiency level, this feature has so far not been able to be used for its own benefit in current sustainable securitisations. Instead, the focus is – rightly so in the view of the authors – very much on the use of proceeds approach in order to support the financing of the transition phase until such assets are more widely available.

Despite its rather accidental development, the establishment of a regulatory framework is crucial for the further development of the market for sustainable securitisations as the introduction of a reliable set of standards would greatly foster transparency and credibility of sustainable securitisations in the eyes of investors, regulators, politicians

and other stakeholders, thereby avoiding any greenwashing issues. It appears that the European Green Bond Standard is, in the short term, set to be the available regulatory platform for the issuance of sustainable securitisations.

Interestingly, and similar to the STS regime, this standard involves the concept of a (mandatory) external reviewer as a crucial element in order to verify, on a pre- and postissuance basis, the compliance of EU green bonds and their

issuers with the taxonomy-compliant use of proceeds, the environmental strategy of the issuer and other aspects of the bond issuance required under the European Green Bond Standard. Given the widespread acceptance of the STS label over the last four years, it can only be hoped that the new segment of sustainable securitisation will be met with similar success. In this case, the extra effort required from issuers and investors will be surely worth the effort.

In any case it would be highly desirable to witness a levelplaying field between securitisation and other comparable fixed income instruments regarding the applicable sustainability requirements so that securitisations can play an active role within the overall market for Green Bonds.

(1) Regulation (EU) 2017/2402 of the European Parliament and of the Council of 12 December 2017 laying down a general framework for securitisation and creating a specific framework for simple, transparent and standardised securitisation

(2) Regulation (EU) 2021/557 of the European Parliament und of the Council of 31 March 2021, amending Regulation (EU) 2017/2402 laying down a general framework for securitisation and creating a specific framework for simple, transparent and standardised securitisation to help the recovery from the COVID-19 crisis

(3) In the following, the designations „sustainable securitisations“, „green securitisations“ and „ESG-compliant securitisations“ are used on a fully

interchangable basis, with the common denominator being that they represent securitisation transactions that comply with one or more of the environmental, social, and governance (“ESG”) criteria.

(4) See Point 84 of the EBA Guidelines on the STS criteria for non-ABCP securitisation.

(5) See Articles 20 and 21 of the Securitisation Regulation.

(6) See Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector.

(7) European Banking Authority, European Securities and Markets Authority and European Insurance and Occupational Pensions Authority

(8) See Joint Consultation Paper: STS securitisations-related sustainability disclosures, published by the Joint Committee of the ESAs dated 2 May 2022.

(9) See „Green Bond Principles“ (June 2021) and „Social Bond Principles“ (2021) published by the International Capital Market Association („ICMA“) which have been complemented by updated guidelines such as „Sustainable Securitisation – Related Questions“ (June 2022)

About STS Verification International GmbH and True Sale International GmbH

STS Verification International GmbH (“SVI”) is a third party verifier authorised to perform the STS verification of compliance of true sale ABCP and non-ABCP securitisations and synthetic on-balance sheet securitisations with the STS criteria. Since having become operational in early 2019, SVI has verified more than 150 securitisations across all eligible transaction types, asset classes and throughout the European Union. SVI is wholly owned by True Sale International GmbH (“TSI”), a leading securitisation industry body in the German and European structured finance markets. TSI emerged in 2004 from a banking initiative in Germany to promote the German securitisation market. Today, the topics of the TSI go far beyond this and cover broad areas of the asset-based finance market.

Download as PDF

Sustainable Securitisation – too complicated or worth the effort?

This article is part of a series Wolf Theiss experts Mathias Schimka and Nevena Skocic created in cooperation with SVI and its parent company TSI:

- The European Green Bond Standard – Gold standard for green bonds or regulatory burden? (Article 1, November 2022)

- Sustainable Securitisation – too complicated or worth the effort? (Article 2, December 2022)

- Green Bonds and Securitisation – the market participant´s view (Interview, January 2023)