Updated EBA report on monitoring Additional Tier 1, Tier 2 and TLAC/MREL eligible liabilities instruments

On 21 July 2023, the European Banking Authority (“EBA”) published its “EBA Report on the monitoring of Additional Tier 1 (AT1), Tier 2 and TLAC/MREL eligible liabilities instruments of European Union (EU) institutions – Update” (EBA/Rep/2023/23) (the “EBA Report”).

The EBA Report merges and updates the content of the two previous separate reports of the EBA in the fields of monitoring Additional Tier 1 (“AT 1”) , as well as total loss absorbing capacity (“TLAC”) and minimum requirement for own funds and eligible liabilities (“MREL”) instruments.

In addition, the EBA has added new recommendations/clarifications on certain contractual clauses of the terms and conditions it has reviewed (for further details see point 2 below). Moreover, the EBA Report contains numerous recommendations/clarifications for drafting and improving/amending the current market practice and wording of contractual clauses, which makes the EBA Report also useful for those issuers for which the newly introduced points are not (directly) relevant.

1. Introduction

1.1 Background

The CRR lays down the eligibility criteria as regulatory capital for AT 1 instruments (Articles 52 to 54 CRR), Tier 2 instruments (Articles 63 CRR) and eligible liabilities (Articles 72b CRR). Those criteria are supplemented by the Commission Delegated Regulation (EU) No 241/2014.

The EBA has focused its work primarily on the assessment of selected issuances of AT 1 and Tier 2, senior non-preferred (“SNP”), senior holding company and senior preferred (“SP”) MREL eligible liabilities instruments. The terms and conditions of these selected issuances were assessed against the regulatory provisions in order to identify provisions that the EBA would recommend and, in contrast, recommend avoiding.

1.2 Content

The EBA Report is structured as follows:

- the EBA’s considerations on AT 1, Tier 2 and eligible liabilities instruments monitoring (i.e. detailed analysis of eligibility criteria common to/relevant for AT 1, Tier 2 and eligible liabilities instruments);

- a follow-up on the “Opinion of the European Banking Authority on the prudential treatment of legacy instruments” (EBA/Op/2020/17) dated 21 October 2020 (link); and

- the EBA’s considerations on own funds or eligible liabilities instruments with ESG features.

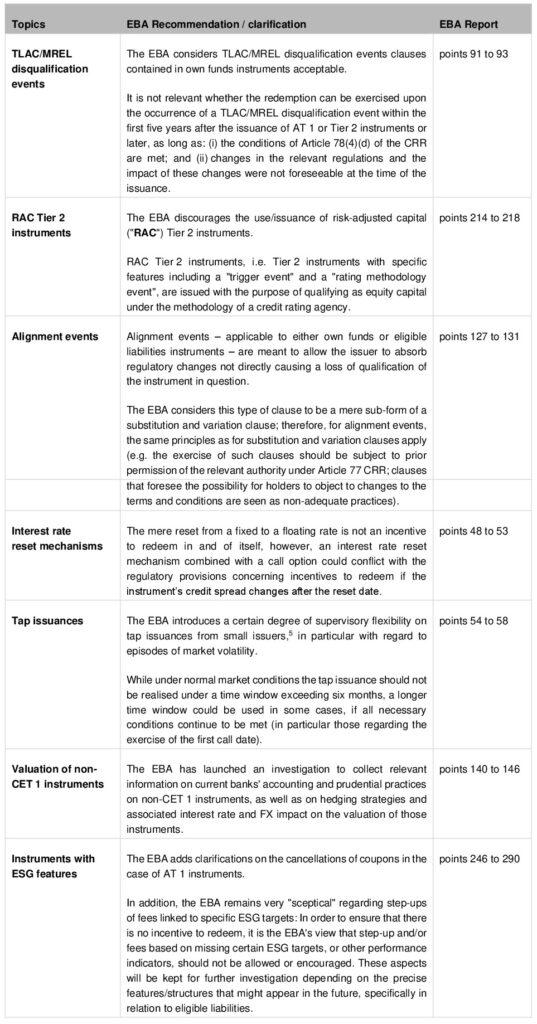

2. New recommendations / clarifications

The below table contains a summary of the main new recommendations/clarifications by the EBA in the Report:

3. Conclusions and outlook

Overall, the EBA has observed convergence and standardisation in terms of drafting of the terms and conditions of the instruments and issuance programmes. The EBA considers this also as a result of the implementation of recommendations contained in the previous EBA reports on the monitoring of AT 1 and TLAC/MREL instruments. In addition, the EBA expects that forthcoming issuances will continue to retain a high level of standardisation in their terms and limit complexity.

As a consequence, apart from accepting MREL/TLAC disqualification events also for own funds instruments, the EBA Report does not really contain surprising new requirements.

The EBA also announced that going forward, it will not only continue to monitor the quality of the AT 1, Tier 2 and TLAC/MREL instruments, but also “stand ready to provide additional guidance where necessary“.

Download the Client Alert here